Why did repo rates spike in September?

A mid-September cash crunch led to a spike in very short-term rates in the repo markets, where banks exchange high-quality collateral for cash with an agreement to buy back those assets with interest. ... Fed officials have puzzled over the banks' unwillingness to lend into the market when the Sept. 17 disruption happened.

What Happened in Money Markets in September 2019?1

Sriya Anbil, Alyssa Anderson, and Zeynep Senyuz

In mid-September 2019, overnight money market rates spiked and exhibited significant volatility, amid a large drop in reserves due to the corporate tax date and increases in net Treasury issuance. Although some upward pressure on money market rates due to these seasonal factors was expected, the extent of the increase in both the level and volatility of rates in secured and unsecured markets was surprising. In this note, we review the money market events of September 2019 and discuss the factors that may have contributed to the sharp rate movements in the repo market and the associated pressures in the fed funds market.

What happened?

The moves in both secured and unsecured rates on September 16 and 17 were much larger than any of those observed over the past few years. Figure 1 shows the effective federal funds rate (EFFR) and the secured overnight financing rate (SOFR), a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities, since December 2015. The EFFR has been quite stable and only printed outside the FOMC's target range on one day before September 17. While SOFR has been more volatile compared to the EFFR and exhibited some quarter-end seasonality, it rarely moves more than 20 basis points on a day.

On Monday, September 16, SOFR printed at 2.43 percent, 13 basis points higher than the previous business day. With pressures in the repo market spilling over into the fed funds market, the EFFR printed at 2.25 percent, 11 basis points above the Friday print and at the top of the FOMC's target range. On September 17, the EFFR moved above the top of the target range to 2.3 percent and the SOFR increased to above 5 percent.

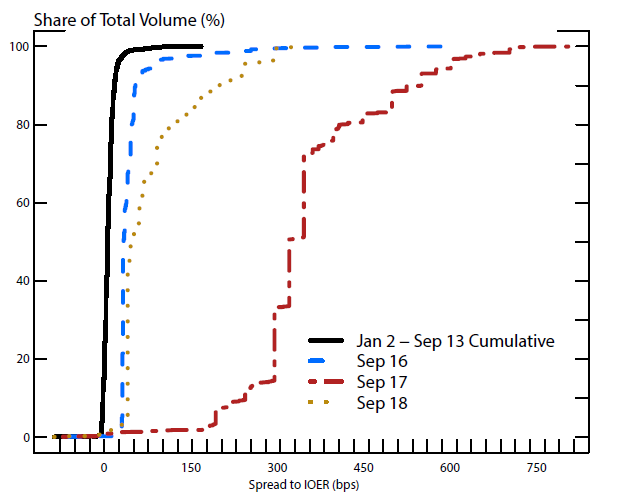

Figures 2 and 3 show the shift in the distribution of trades in the repo market and the fed funds market, respectively. On September 16 and 17, the range of trades in both markets expanded significantly and rates shifted higher. Following the repo operations by the Federal Reserve Bank of New York (FRBNY), announced on September 17, the distribution of rates in both markets reverted closer to the average distributions observed over the year the next day.

https://www.federalreserve.gov/econres/notes/feds-notes/what-happened-in-money-markets-in-september-2019-20200227.htm

From and including: Tuesday, September 17, 2019

To, but not including Wednesday, March 11, 2020

Result: 176 days

Or 5 months, 23 days = 523

25 weeks and 1 day = 251

48.22% of a common year (365 days)

From and including: Tuesday, September 17, 2019

To and including: Wednesday, March 11, 2020

Result: 177 days

Or 5 months, 24 days

25 weeks and 2 days

48.49% of a common year (365 days)

From and including: Tuesday, September 17, 2019

To, but not including Friday, March 13, 2020

Result: 178 days

Or 5 months, 25 days

25 weeks and 3 days

48.77% of a common year (365 days)

From and including: Tuesday, September 17, 2019

To and including: Friday, March 13, 2020

Result: 179 days

Or 5 months, 26 days

25 weeks and 4 days

49.04% of a common year (365 days)

From and including: Tuesday, September 17, 2019

To, but not including Tuesday, January 21, 2020

Result: 126 days

Or 4 months, 4 days

18 weeks

34.52% of a common year (365 days)

From and including: Tuesday, September 17, 2019

To, but not including Tuesday, May 5, 2020

Result: 231 days

Or 7 months, 18 days

33 weeks

Trump Iran tweet points to 6/5/2020 too.

Trump tweet timestamp 8:08 AM the 488th minute of the day

https://twitter.com/realDonaldTrump/status/1252932181447630848?s=20

"Blood Moon Eclipse" = 488 (Jewish)

Four lunar eclipses will appear across Earth's skies in 2020. They will all be penumbral eclipses, which means the face of the moon will appear to turn a darker silver color for a few hours. Weather permitting, people across most locations on our planet will catch at least one of the lunar eclipses falling on Jan. 10-11, June 5-6, July 4-5 and Nov. 29-30.

Next one is 6/5 and 6th...

From Iran satellite launch to blood moon eclipse is 44 days.

From and including: Wednesday, April 22, 2020

To, but not including Friday, June 5, 2020

Result: 44 days

No comments:

Post a Comment